tesla model y tax credit 2020

Long Range AWD change trim Avg. You can apply for one from a bank credit union or other lending institutions your car dealer can even help you apply.

First Drive Review 2020 Tesla Model Y Sets The Benchmark For Electric Crossovers

31 2019 no credit will be available.

. Does anyone know why. Plug-In and Drive with Chevy Energy Assist in the 2024 Blazer EV. Trade-in Value Get a cash value for your car.

On or after January 1 2024. Tesla Model X Tax Write off California. Since Tesla Model Y is less than 6000 pounds maximum section 179 deduction for Model Y is 10100.

Residential Federal Tax Credit Business Federal Tax Credit For Systems Installed. No accidents 1 Owner Personal use. Polestar 2 Long Range single motor and dual motor 7500.

Also use Form 8936 to figure your credit for. Auto loans are pretty simple once you break them down. The credit is no longer available for Tesla or General Motors vehicles with at least four wheels.

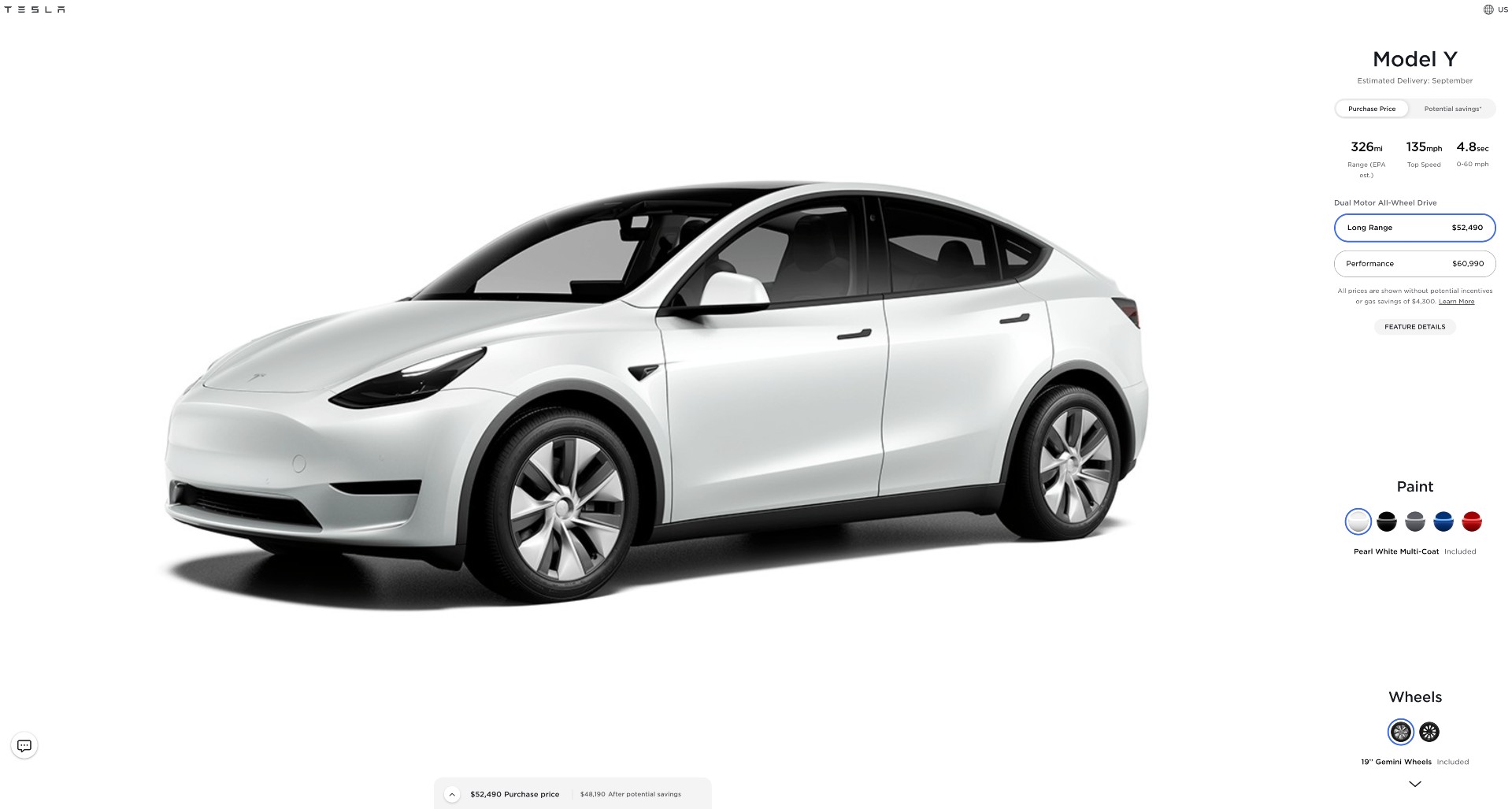

As soon as we tell you that Shaws Model Y really did pay for itself youre probably skeptical. The 2020 Tesla Model Y True Cost to Own includes depreciation taxes financing fuel costs insurance maintenance repairs and tax credits over the span of 5 years of ownership. The main value is based on the base model with no options applied affecting either cost or CO2 emissions.

General Instructions Purpose of Form Use Form 8936 to figure your credit for qualified plug-in electric drive motor vehicles you placed in service during your tax year. January 1 2020 to December 31 2022. EV tax credits jump to 12500 in latest legislation -- with a catch GM would be the big winner with the updated regulations while Tesla would again receive some federal tax credits.

1 Buying through the Corp. There are still a variety of brands that are available for the credit. Theres no longer a 7500 federal EV tax credit.

Benefit in Kind Company Car Tax Rules Review of WLTP and Vehicle Taxes Budget 2020. Long Range 4dr SUV. 2 Buying personal and doing the 100 write-off.

January 1 2023 to December 31 2023. This federal tax credit ranges from 2500 to 7500 for qualified electric vehicles that draw energy from a battery. Which I dont understand because I purchased it when it was and couldnt file for it until 2022.

Ad The 2024 Blazer EV is Available With a GM Estimated Range up to 320 Miles on Full Charge. There is tricky analysis here but it may end up costing you. On the website at the time it said there was still a 2000 Federal tax credit available.

Car sales tax rates are set by your state and unlike other parts of. I purchased my Tesla Model Y in late Feb. Above BIK value and Tax costs are estimates only and precise values will depend on the final specification of each model.

A 90 kWh Tesla would receive an. California has very specific rules pertaining to depreciation and limits any Section 179 to 25000 Maximum per year. Now when I am filing my taxes through TurboTax it says that the credit is no longer available.

Just for fun and assuming there werent a cap a 70 kWh Model S would receive 417 for every kWh exceeding 5 kWh resulting in over 27000 in tax credits. Consult the Canada Revenue Agency or a financial professional for more details and to. The credit reached 0 by the end of January 2020.

You run into an issue if CRA designs your 80000 Model Y is only used lets say 60 or 80 for business. Internal Revenue Code Section 179 Deduction allows you to expense up to 25000 on VehiclesOne year that are between 6000 Pounds and 14000 Pounds or More in the year they are placed in service. The credit was further reduced from July through the end of 2019.

The credit is non-refundable so to enjoy its benefits you must have a federal tax liability in the year of purchase and file Form 8936 to claim the credit. 3 Buying personally and paying mileage. 2 Buying personal and doing the 100 write-off.

2020 Tesla Model Y. 316mi EPA electric range. In anticipation of the upcoming EV tax credits Tesla is adjusting its pricing accordingly.

The new EV tax credits proposed by the Biden administration are bound to encourage more EV sales. In the end 3 beat out 2. As we progress toward a more electric future this tax credit may.

November 14 2021. In conclusion the purpose of this credit is to give buyers a bit of a tax break and encourage the switch to all-electric. 2020 Tesla Model Y.

Enhanced capital cost allowances CCAs enable a higher deduction in the year that an electric vehicle is put on the road up to 100 of 59000 for vehicles acquired between January 1 2022 and December 31 2023. Tesla Model Y 179 Deduction. However if you are in the market for a Tesla Model Y then you might not get as sweet of a deal.

This federal tax credit ranges from 2500 to 7500 for qualified electric vehicles that draw energy from a battery. 2020 Tesla Model Y. So for example if you purchase a vehicle for 100000 you can write off 25 000 as Section 179 in first year and remaining amount of 75000 in this example has to be spread over 5 year.

Tesla Model Y Consumer Reports

First Drive Review 2020 Tesla Model Y Sets The Benchmark For Electric Crossovers

Tesla Model Y Deliveries Now Expected To Commence In Two Weeks

Tesla Model Y Demand Skyrockets Long Range Variant Nearly Sold Out For Q3

2021 Tesla Model Y Review Autotrader

Tesla Model Y Review Pros And Cons Of An Everyday Electric Suv

2022 Tesla Model Y Long Range Awd Pg E Ev Savings Calculator

Tesla Increases Price Of Model Y In Canada Delays Expected Delivery Date

Here S How Tesla Model Y Compares To Other Electric Crossovers Suvs

Tesla Hikes Price Of Model 3 Model Y By 2 000

First Drive Review 2020 Tesla Model Y Sets The Benchmark For Electric Crossovers

Tesla Model Y And Model 3 Dominates By Commanding About 2 3 Of Us Ev Market

California Plug In Car Sales Up 79 In 2021 Tesla Model Y 2 Overall

Is The Tesla Model Y Really Worth 60 000 Will Orders Slow Down

Tesla Adds Lower Priced Model Y Standard Range At Last The Car Guide

2022 Tesla Model 3 Vs 2022 Tesla Model Y Comparison

2020 Tesla Model Y Long Range Awd Ratings Pricing Reviews Awards

Tesla Increases Model 3 And Model Y Prices In Canada Again Making The Entry Level Model 3 Ineligible For The Izev Rebate Update Drive Tesla